This is a summary of a funding scan undertaken for a TAI funder member. TAI seeks to publicly share its research, but this work is not reflective of TAI’s or its member's views necessarily.

Corporate capture is the act of private organizations using undue influence over decision-makers and public institutions. The term “corporate capture” is connected to a worldview and approach that is uncommon among traditional government donors and multilaterals. It is used more by advocates, activists, academics, and policy specialists. Support for anticorporate-capture work tends to come from funders who are committed to issues of social justice and a fundamentally open society, including some of TAI’s members.

This summary presents findings from a scan of funding for issues related to corporate capture. See the longer report for more details.

RELATIVELY LITTLE FUNDING GOES TO ANTI-CORPORATE CAPTURE COMPARED TO OTHER PRIVATE SECTOR ORIENTATIONS

Much more funding directed to trade and business policy and administration in developing countries goes to approaches that are not aligned with anti-corporate capture work but rather private sector development. Some bilaterals and multilaterals support competition authorities and competition policy in developing countries, but this probably was not more than $20 million in total from 2018–2021. The Organisation for Economic Co-operation and Development (OECD) Development Assistance Committee (DAC) data shows trade policy and administration receive substantial funding: almost $2 billion was reported to this code in 2021. However, this funding is almost entirely oriented around trade promotion, capacity building, and similar. Bilaterals and multilaterals do not appear to use the framework of protecting against corporate influence in negotiations when supporting developing countries, though they might support a broader public purpose. A sample project is the European Union supporting Ethiopia with “Capacity building for inclusive and equitable African Trade Arrangements,” disbursing $1.2 million in 2021. Searching for the term “corporate capture” in the 2018–2023 funding data yields just seven funders: the Ford Foundation, Global Greengrants Fund, the Netherlands, Joseph Rowntree Foundation, Sweden, Wallace Global Fund, and Warsh-Mott Legacy. The largest program is the Netherlands-supported Fair, Green, and Global (FGG) Alliance. Looking more broadly at corporate accountability, more funders appear relevant: Hewlett Foundation, Humanity United, Laudes Foundation, the Open Society Foundations (OSF), Wallace Global Fund, and Wellspring Philanthropic Fund.

Using additional data collection methods, we identified 16 potential funders to add to the seven already identified. When searching more broadly, we found that much of the funding related to corporate capture may touch on other issues of funder concern, such as climate change, conservation, extractive industries, labor rights, responses to technology, governance, anti-corruption, and support to human rights and business. In addition, some funders have a specific geographical focus such as the Omidyar Network (ON) in the US and the Joseph Rowntree Foundation in the UK. In addition, the Ford Foundation has relevant organizations through the Building Institutions and Networks (BUILD) program, which provides general operating support rather than sector-specific project funding. Looking at trade and investment specifically, one interviewee noted that there is a long history of environmental, human rights, and labor organizations working on these. As for current funders on trade and investment, we uncovered less information, though a prior trade funders’ group was noted.

FUNDING TO THE GLOBAL NORTH ON THESE ISSUES HAS INCREASED

Without consistent data codes, the best way to estimate the historical trend in funding is to look at the funders entering and exiting the field and their levels of funding. ON and Hewlett-ESI have invested substantial funds to these issues in the US. The Netherlands supports the FGG Alliance. On the other hand, Luminate exited its relevant portfolios. Based on this, we assume funding in the US and Europe increased substantially.

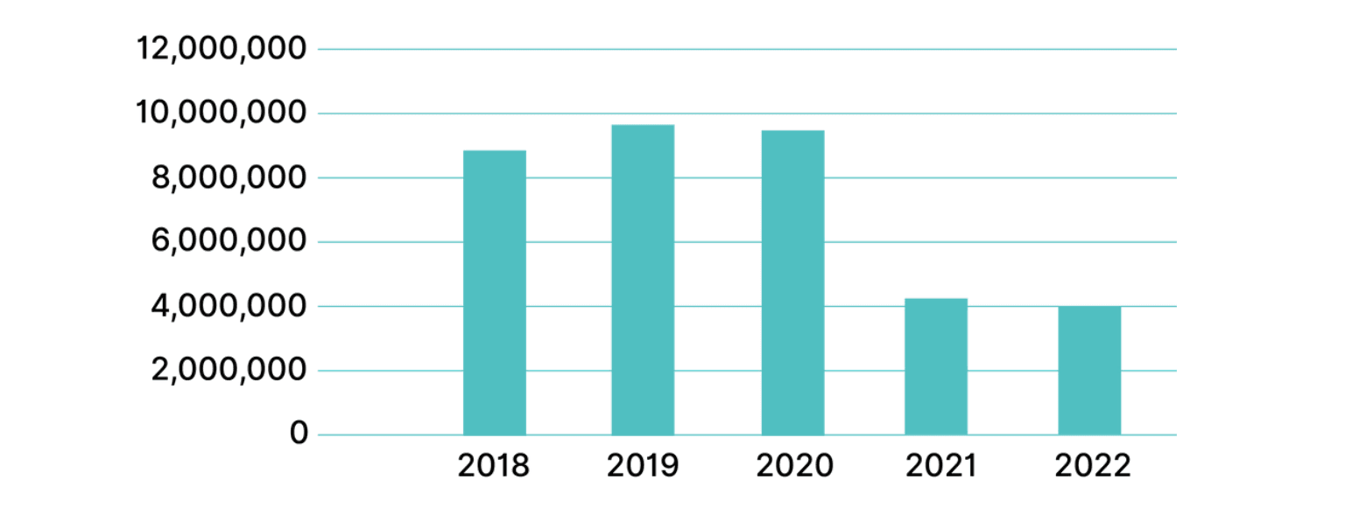

To triangulate this, we looked for a trend in funding mentioning “corporate accountability” in Candid. Funding to projects mentioning “corporate accountability” fell by over half from 2018 to 2022 without accounting for inflation. There are many interpretations for this trend, such as funders using other terms, a genuine shift away from corporate accountability during the pandemic, or even just a lack of reporting. At a minimum, it suggests that larger funders working on anti-corporate capture and new economic thinking are not using the term to describe their grants.

WHY IS THERE NOT MORE FUNDING IN THE GLOBAL SOUTH?

Finding a trend for funding in developing countries is difficult. In the OECD DAC data, the levels of relevant funding on corporate capture are low. It is not easy to parse out the relevant funding of the FGG Alliance, but its strategy goes through at least 2025. Other funders appearing in the data include Ford and OSF. As of this writing, OSF is transitioning to a new model. As to why there was not more funding in these areas in the Global South, interviewees and the authors speculate a wide range of possibilities, including the issues being politically charged, the challenging nature of the issues, unclear evidence for impact from interventions, the issues being transdisciplinary, and lack of expertise in donors.

One interviewee wrote, “We note with concern thatfunding for this work has notincreased substantively. There has been solid supportin some areas—for example,for corporate capture work on extractive industries and health justice—however, we need a significantfunding stream to tackle the range of challenges related to corporate capture.”

Major funders expect their current budgets to continue more or less as-is through 2025. In addition, two funders also expect interest in US economic justice to grow. This gives a sense of the zeitgeist. One clear recommendation arose: As funders consider what they will do next, they should consider talking more to each other. “We need funders to be bold, act collectively, and ensure that other funders all see the importance and intrinsic merit of funding such work. An element of this support might not only be grant-making but also convening and fostering opportunities for partnerships between organizations working on these issues across the globe,” wrote an interviewee. We recommend funders in this area continue to discuss this amongst themselves and the field, especially as they look to support a global movement. Funder groups already touching on these areas include the Economic Paradigm Funders Group, Funders Organized for Rights in the Global Economy (FORGE), Partners for a New Economy (P4NE), and Strengthening Accountability in the Global Economy (SAGE).